In a world where self-directed investment is becoming a norm, persistently low financial literacy in many countries raises concerns. Engagement with digital investing apps can build experience and confidence, but what is the true extent of investor engagement? Is providing access to better advice the only real solution?

Financial literacy gaps are significant

Statistics on financial literacy vary, but most countries show significant deficiencies, particularly among populations with lower incomes, female investors and specific ethnic groups. Moreover, surveys are often geared towards the basics of household finance, neglecting the complexities and risks of investment products. This lack of financial literacy is of special concern at a time when long-term retirement plans increasingly require self-directed private provisioning, and financial advice is limited.

For example, despite the US population having some of the highest financial literacy globally, TIAA’s regular index on this topic showed that only 50% of questions were answered correctly.¹ The OECD shows an average of 13 out of 21 for their global index for its member

countries.²

Achieving financial or investment literacy is not just a case of undertaking a course in financial theory. It requires practical experience built by experiencing multiple market situations. The extent to which people engage and participate are key factors of improved financial literacy.³ It is for this reason that looking at changes in investor engagement levels can be informative. And, that benefits of engaging investors go beyond simple relationship building; strong engagement helps investors build confidence and knowledge to make the right investment decisions for the long term.

Digital investment platform engagement is increasing

Engagement can be measured by looking at how frequently investors are interacting with financial advisors, apps and media. FNZ looked at data from our direct-to-investor digital wealth platform to understand engagement patterns. We translated this into an “Engagement Index”.

The FNZ data shows that investor engagement is increasing (Figure 1). Regardless of age, gender or wealth bracket, investors increased engagement over the last five years. And, this is consistent both before and after the pandemic. Finally, it shows that the increase in engagement can be largely and increasingly attributed to checking holding valuations and viewing data and research, rather than just order entry.

Find out more about FNZ engagement insights: “3 Myths of Digital Engagement”

Figure 1: Investor engagement with digital wealth platforms (pre- and post-pandemic)

Despite this encouraging trend in digital platform engagement, large swathes of the worldwide population have low levels of market participation. Even when looking at developed economies, where financial literacy is relatively high, significant amounts of financial assets remain uninvested.

According to OECD data (Figure 2), total household wealth held as cash deposits range from 13% in the US, Sweden and Denmark to more than 50% in Japan.⁴

This has changed little over the past decade. There have been significant increases in Nordic countries, Spain, Ireland and the Netherlands. But elsewhere, including the UK, France, Poland and Portugal, assets have increasingly been left in cash.

Figure 2: Percentage of household wealth held as cash deposits, 2012 vs 2022⁴

Market participation is mainly through intermediate collective funds, rather than direct investment in stocks and bonds. OECD data confirms, perhaps unsurprisingly, that most private financial wealth is invested via institutions such as occupational workplace retirement plans – and this trend continues to increase.

Few investors are directly participating in the stock markets with more than 20% of their financial wealth (US and the Nordic countries are again the exceptions).⁴ Notably, investors in UK, France and Germany have less than 6% invested in publicly traded equities.⁵ Given financial literacy’s intrinsic link to the level of market participation,³ this highlights the increasing importance of professional advice and asset management.

Is better access to professional advice the answer?

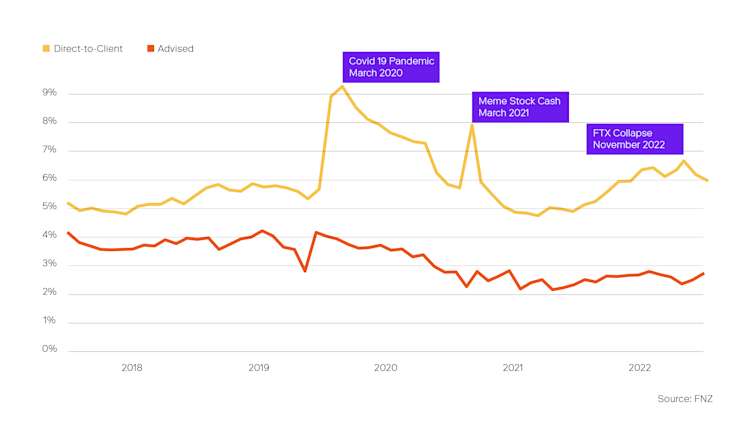

The impact of financial advice on investor behavior is highlighted in the chart from FNZ, which looks at the difference between self-managed and advised investment behavior: advised investors are less susceptible to market swings and typically keep more of their available funds invested.

Figure 3: Percentage of platform-based investments held as cash deposit: Unadvised investors seem to act against their own best interests in times of turmoil.

However, access to good investment advice is limited. Investors continue to resist paying direct fees and generally distrust advisors. The UK case of completely banning product distribution commissions and simultaneously increasing regulatory constraints for advice is probably the clearest example of how investor behavior can be impacted. Data shows there has been steady move away from holding wealth as direct securities and fund investments.⁴ ⁵

The question of advisor reach is also critical, and there are key regional differences. European and Asian data is complex to assess and compare due to the use of bank relationship managers as intermediate advisors and a diverse mix of fee models. However, in Australia

non-commissioned advisors are said to be advising an average of 90 investors each.⁶ In the UK, non-commissioned advisors, who are tied to a wealth platform, have an average of 115 clients.⁷ And in the U.S., it appears there are upwards of 150 investors per Registered Investment Adviser.⁸

When looking at the total employed population of each country, it would require a massive up-tick in the number of advisors to bridge the advice gap. Yet the opposite is happening as advisor numbers decline in many countries.

Tech driven wealth platforms will help bridge the gap

Technology innovations are key to advisors helping more investors. And artificial intelligence will likely bring a step change in bridging the advice gap. For example, investment management technology is being deployed that enables mass personalized portfolios and

direct investments at scale, and that automates the onboarding, planning and document management processes to enable the advisor firms to focus 100% of their efforts on the client portfolios. This way they have more time to serve a wider audience.

The impact of digital platforms on end-investor financial literacy is trickier to assess. Research does indicate that increasing market participation and engagement can help to build confidence and trust in the market, which can contribute to improving financial literacy over time. And clearly, using a digital platform to improve investor engagement is a good way not only to gain participation and build confidence, but also ensure closer relationships, better transparency and easier access - which can only be a good thing for all.

Find out more about FNZ engagement insights: “3 Myths of Digital Engagement”

References

1. TIAA (2022), The 2022 TIAA Institute-GFLEC Personal Finance Index

2. OECD (2020), OECD/INFE 2020 International Survey of Adult Financial Literacy

3. Journal of Pension Economics and Finance(2022), Vol. 21 , Issue 4 , pp. 634 – 664, DOI

4. OECD (2023), Household financial assets, doi: 10.1787/7519b9dc-en (Accessed on 07 July 2023)

5. Eurostat (2021), Can responsible investing encourage retail investors to invest in equities?

6. Advisor Ratings (2022), Australian Financial Adviser Landscape 2022

7. Platforum (2022), What’s the maximum number of clients per adviser?

8. IAA (2021), Investment Advisory Industry Snapshot 2021

9. FNZ (2023), 3 Myths of Digital Engagement, A proprietary index measuring session data on FNZ’s direct-to-client digital investment platform