What does FNZ’s global platform data indicate about myths of digital engagement?

Ensuring investors are actively engaged with their wealth platform has many benefits. But how engaged are they really? Have investor interactions with wealth platforms changed since the pandemic? At times, our industry draws conclusions about end investor behavior that need to shift, so we looked at FNZ’s global platform data to see what it would tell us about three commonly held beliefs about digital engagement.

FNZ’s digital wealth platform data provides opportunity to explore engagement levels. We analysed aggregated, anonymous data to create a simple composite “engagement index” measuring investor interactivity with FNZ’s direct-to-client digital wealth platforms, serving as a proxy for assessing general investor interest in their investments.¹ The comparison between 2019 and 2023 is chosen to cover periods just before and after the pandemic.

As digital natives, wouldn’t you expect Millennials to be well ahead of older generations when it comes to investment app usage? Or, are GenXers and Baby-boomers catching up with their younger peers?

What does the data say?

Our data shows that the engagement gap between younger and older investors has decreased significantly over recent years. Millennials remain the most engaged age group, but activity from GenX has increased significantly. In ten year’s time, will there be any difference?

Conclusion:

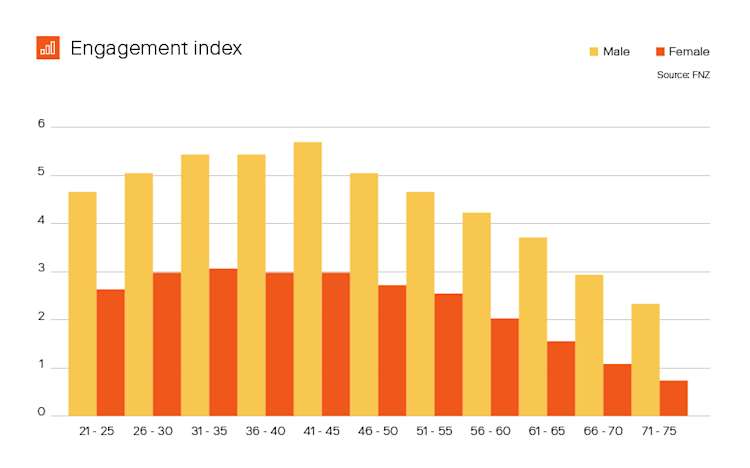

With increasing amounts of wealth in the hands of female investors – and the growth of a range of female wealth segments – the level of engagement of female investors must surely be increasing. But how does this compare to male investors - are women now interacting more and catching up?

What does the data say?

According to our data, both male and female investors have become more engaged with their investment apps. However, male investors are still more than 2x as engaged as female investors on digital platforms. The gap has reduced marginally over the last four years from 57% to 54%. However, this is not a significant shift. This may change: for younger investors that gap is much less.

Conclusion:

We often think of the wealthy not needing to interact with digital apps directly, because of course they would have staff on hand to manage their finances. But is this assumption always correct? Wouldn’t affluent investors, who have more invested than others, also spend more of their time interacting with digital investment apps?

What does the data say?

Our data shows that the more an investor has invested the more engaged they are with their investment app. However, we also know that high-net-wealth individuals rely heavily on investment advisers to advise them day to day. So it still begs the question, are they just passively monitoring and accepting recommendations or are they actively investing?

Conclusion:

So, what are investors engaged with?

87% of all engagement involves passively checking portfolio statements, as well as researching options.

In practice, the vast majority of activity every month involves checking accounts and portfolio holding valuations. Nevertheless, we have seen increases in investors researching options, with views of fact sheets increasing by 68% over the last four years. This is perhaps a positive signal for improving financial literacy, as it shows that investor interaction is not solely about execution and monitoring, but also actively assessing and researching options.

How could a 28% increase in digital engagement benefit you?

FNZ data shows engagement with FNZ digital platforms has increased significantly over the last four years. Investors do appear to be taking a greater interest in their long-term financial options and are interacting more often when using such a platform. We have seen engagement increase by 28% over this time.

Increasing engagement with digital investments and savings platforms has a range of benefits from improving relationship and loyalty to investor financial literacy and product access. Regular touch-points lead to a better understanding of financial investments and improves investment discipline.

Engagement with digital wealth platforms is helping to open up wealth to a wider investor population. The increase in engagement across wealth bracket, age and gender shows that digital wealth platforms are having a significant impact on investor behaviour across a whole spectrum of investor types.

Notes:

1. The engagement index method is a proprietary FNZ calculation. It is largely based on average quantity of investment app sessions per user within each time period.

Important information

This document is proprietary to the FNZ Group, confidential and is for the intended recipient(s) only and should not be duplicated, or distributed to any third party, without the written consent of the FNZ Group. If you are not the intended recipient, please inform the provider and delete any copies from your system. Electronic documents are not always secure and therefore the FNZ Group does not accept legal responsibility for the contents of the document and any view expressed by the provider as these are not necessarily the views of the FNZ Group. For more information on the FNZ Group please visit our website.

The information contained herein has not been verified, approved or endorsed, or independently verified, by any independent third party. No responsibility or liability is accepted by the FNZ Group or by any of its directors, officers, employees or agents in relation to the accuracy, completeness or sufficiency of any information contained herein or any other written or oral information made available by the FNZ Group in connection therewith or any data which any such information generates, or for any loss whatsoever arising from or in connection with the use of, or reliance on, this document and any such liability is expressly disclaimed. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, estimates, forecasts, targets, prospects, returns or other forward-looking statements contained herein. Any such projections, estimates, forecasts, targets, prospects, returns or other forward-looking statements are not a reliable indicator of future performance. Nothing in this document should be relied upon as a promise or representation as to the future. The FNZ Group gives no undertaking, and is under no obligation, to provide the recipient with access to any additional information or to update this document or to correct any inaccuracies in it which may become apparent.

This document is for discussion purposes only and does not constitute or form any part of any (i) invitation or inducement to engage in investment activity; or (ii) offer, solicitation or invitation for the sale or purchase of any securities or other investments.