Success Story

The modern advice platform

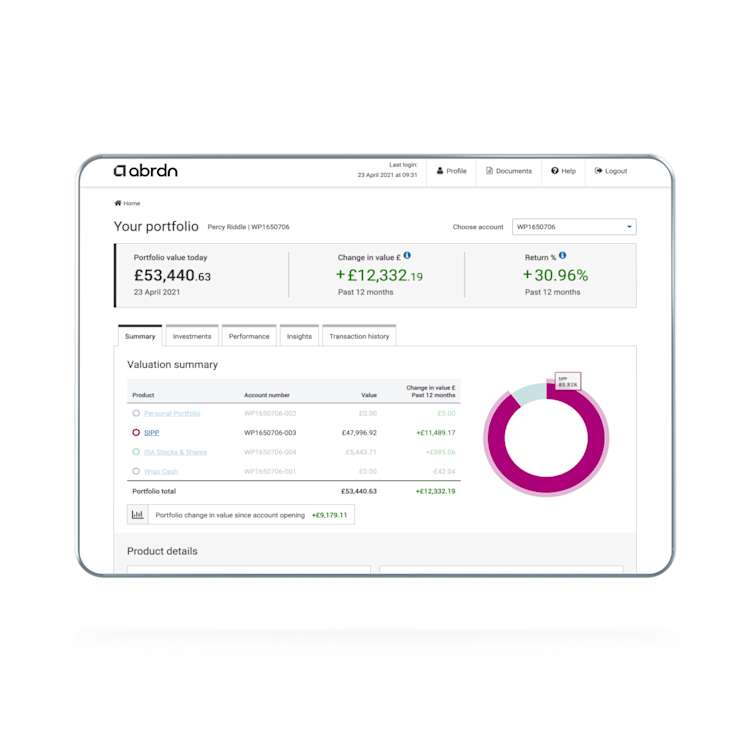

Abrdn aimed to create a sophisticated independent financial advice (IFA) platform in the UK, minimizing initial expenses. To achieve this, they joined forces with FNZ to co-create a cutting-edge platform. This collaboration led to rapid growth, propelling the platform's assets under administration (AUA) from £0 to £86 billion. Today, this technology is widely recognized as a top-tier IFA platform in the UK, acknowledged for its impressive AUA and net capital flows.