Shaping the Future of Wealth Management: Technology, Personalization, and the Next Generation of Investors

The future of wealth management is unfolding before our eyes, with a perfect storm of technological innovation, shifting investor demographics, and evolving regulatory landscapes reshaping how financial services are delivered. To remain competitive, financial institutions must anticipate and adapt to these changes, transforming their offerings to meet the expectations of next-generation investors.

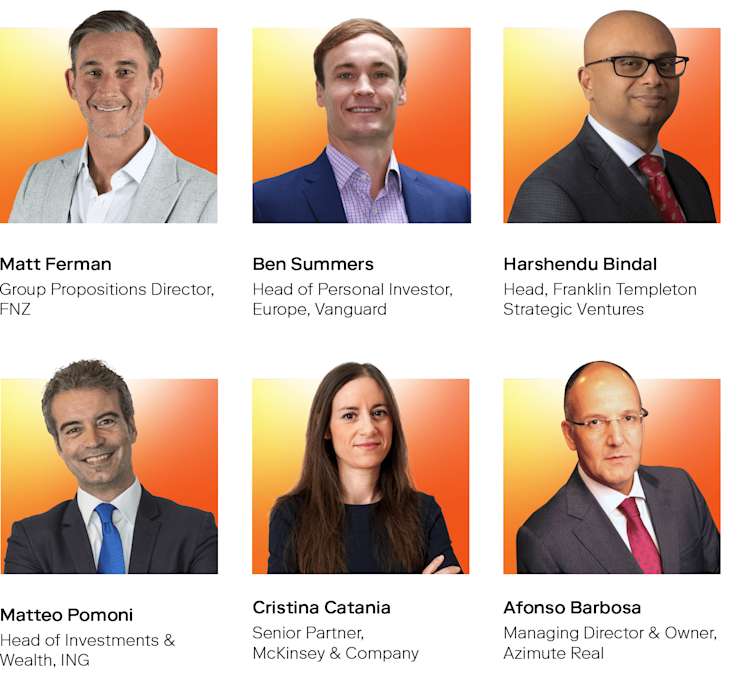

In our recent on-demand webinar, top global experts from FNZ, Vanguard, ING, Franklin Templeton, McKinsey, and Azimute Real came together to discuss the strategies leading companies are using to launch cutting-edge wealth offerings for retail investors. These strategies provide a roadmap for financial institutions looking to stay ahead of the curve in this rapidly evolving space.

Here are some of the key themes and strategies discussed in the webinar that leading financial companies around the world are implementing to launch next-generation wealth offerings for retail investors.

Personalization at Scale: Meeting Next-Gen Investor Expectations

The new wave of investors - led by millennials and Gen Z - are fundamentally different from their predecessors. They demand personalized, tech-driven solutions that allow them to engage with their finances on their terms. Unlike previous generations, who typically relied on financial advisors and traditional wealth management channels, today’s investors want real-time, digital engagement.

"Clients now expect a seamless, personalized digital experience where their provider knows them and their goals," said Ben Summers, Head of Vanguard’s Personal Investor Business in the UK. This represents a shift in wealth management from being transaction-based to relationship-based, where understanding a client’s unique financial goals is paramount.

Financial institutions must use technology to meet these expectations. Summers highlighted the critical role that AI plays in this evolution: “AI allows us to deliver a more personalized experience at scale, making it possible for financial institutions to serve a broader range of clients in a tailored way.”

To achieve this, firms need to go beyond generic solutions and create hyper-personalized experiences that reflect the unique financial situations of each client. As Cristina Catania, Senior Partner at McKinsey & Company, put it, “The future of wealth management will not just be about offering generic advice but tailoring services to real needs, beyond the old ‘one-size-fits-all’ approach.”

Democratizing Wealth Management: Lowering Barriers to Entry

Historically, investing has been the domain of high-net-worth individuals with access to exclusive opportunities and personalized advice. However, technology is leveling the playing field, enabling more people to participate in capital markets. This democratization of wealth management is particularly vital as firms seek to engage younger and more diverse investor bases.

Harshendu Bindal, Head of Strategic Ventures at Franklin Templeton, said: "We’re seeing platforms like Acorns and Stash successfully target younger investors by making investing feel accessible." He added:

Micro-investing solutions that align with everyday habits, like rounding up purchases to invest, make it easier for people to start investing without feeling overwhelmed by complexity.

Similarly, Matteo Pomoni, Head of ING Italy’s Wealth Business, emphasized the growing role of robo-advisors in this space. “Technology is enabling us to deliver personalized advice at scale, even for retail and mass-affluent clients. This is crucial for expanding access to wealth management services that were once reserved for a select few.”

Firms must also rethink how they support these investors, not just by offering products but by improving financial literacy and empowering them to make informed decisions. Matthew Ferman, Group Propositions Director at FNZ, stated, “A lack of financial literacy has long been a barrier. But new digital tools that focus on education and guidance can help demystify investing, especially for first-time investors.”

The AI Revolution: Transforming How People Invest and Receive Advice

AI’s transformative potential in wealth management cannot be overstated. AI is already playing a significant role in enhancing efficiency, lowering costs, and improving customer experiences. But the true power of AI lies in its ability to personalize wealth management services like never before.

Summers noted that AI enables firms to go beyond simple transactional advice: “You can imagine a generative experience where all the platform’s best thinking comes together to meet a client’s needs, whether it’s personalized advice, products, or services.”

While today AI is primarily used for optimizing basic tasks, such as customer service chatbots or portfolio management, the future will likely see a far deeper integration. Bindal added, “Right now, we’re in the conversational AI phase. But over time, AI will evolve into predictive AI, capable of uncovering investor biases and improving the accuracy of financial advice.”

The potential for AI to change the advisor-client relationship is immense. Pomoni noted how AI can support financial advisors: “It’s not about replacing human advisors but helping them deliver better advice by preparing the groundwork—analyzing portfolios, market conditions, and client goals—so that meetings are more productive.”

Still, Catania warned that firms must tread carefully, ensuring that AI is used responsibly and ethically: “Trust in AI will be critical. We need to make sure the technology we’re using is transparent and designed to enhance, rather than erode, client relationships.”

Evolving Asset Classes: Expanding Beyond Traditional Investments

As investors look for new ways to diversify their portfolios, alternative asset classes—such as private markets, digital assets, and thematic investments—are gaining prominence. These non-traditional investments offer fresh opportunities for growth, particularly for younger investors seeking exposure to emerging sectors like ESG (Environmental, Social, Governance) and crypto assets.

Bindal shared that interest in digital assets and tokenization is growing: "It’s conceivable that in the next decade, all investments will reside in digital wallets. The use of blockchain and tokenization will not only reduce costs but also improve transparency, making it easier for retail investors to access previously illiquid markets."

Pomoni also highlighted the potential for democratizing private markets:

Private equity and other traditionally exclusive asset classes are becoming more accessible, thanks to new technologies that lower the entry threshold.

Meanwhile, Catania pointed to the enduring appeal of ETFs, particularly in the sustainable investing space: “ESG-themed ETFs and impact investments are drawing considerable attention, as investors are increasingly looking to align their portfolios with their personal values.”

Navigating Regulatory Shifts: A Challenge and an Opportunity

Finally, the wealth management industry is being reshaped by evolving regulations, including the Retail Investment Strategy. These changes present both challenges and opportunities for financial institutions. While they may increase complexity and compliance costs, they also encourage firms to innovate and better serve retail investors.

Afonso Barbosa, Managing Director of Azimute Real, noted,

The new regulations will pressure firms to reassess their business models, but they also create an opportunity to deliver more value to clients through transparency and tailored solutions.

Catania emphasized that smaller, niche players will still find space in the market: “Wealth management is inherently local, and while large institutions will continue to lead, there’s room for smaller firms to thrive by offering specialized, high-quality advice.”

Preparing for the Next Era of Wealth Management

The future of wealth management is being defined by the convergence of technology, changing investor expectations, and regulatory shifts. As AI, tokenization, and digital assets transform the landscape, firms must prioritize personalization, accessibility, and trust to remain competitive.

As Summers aptly noted, “There’s never been a more important time to put ourselves in our client's shoes.” By leveraging emerging technologies and staying attuned to the evolving needs of next-generation investors, wealth management firms can lead the charge into this new era.

Watch on-demand now

To explore how top financial firms are navigating these changes and leading the way in next-gen wealth management, watch the full webinar on-demand now!