For many people, property represents a significant financial asset. Nokkel and FNZ explored the integration of house wealth in financial planning, partnering on research conducted by the lang cat. This includes the potential of home equity release to address the looming retirement income crisis.

Accessing the equity in a home for non-housing uses has some difficult history. There have been cases of vulnerable people being sold inappropriate, high-cost options, often resulting in poor outcomes for end-clients.

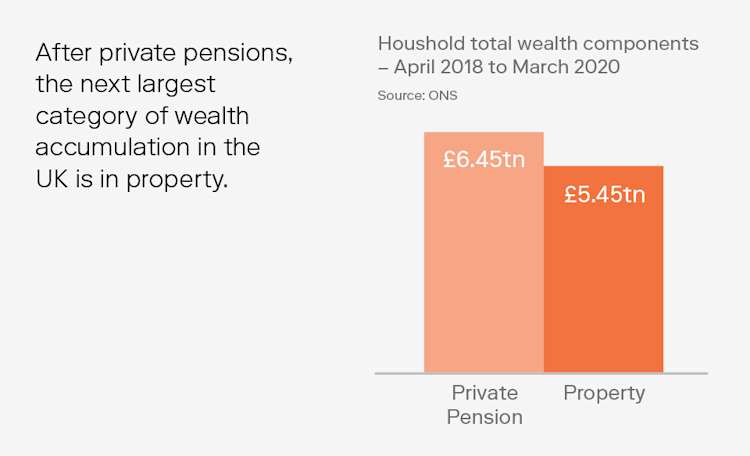

But for many people, the equity in their homes represents a significant, if not their largest, pool of savings.

This suggests that the wealth management industry may be under-serving investors by not integrating home equity into financial planning. By adding property, advisors and end-clients can view a truly holistic picture of assets and make more informed decisions. The wealth accumulated in a house could enhance life experiences (such as holidays), improve home value (such as home improvements), help children (such as first time buyer aid), or – arguably the most important – address a growing global retirement income gap [1].

Scottish Widows estimated that, for most regions of the UK, home ownership equity release could provide an additional £60,000 to fund retirement. In the Southeast this doubles to over £120,000 and in London it is over £170,000.

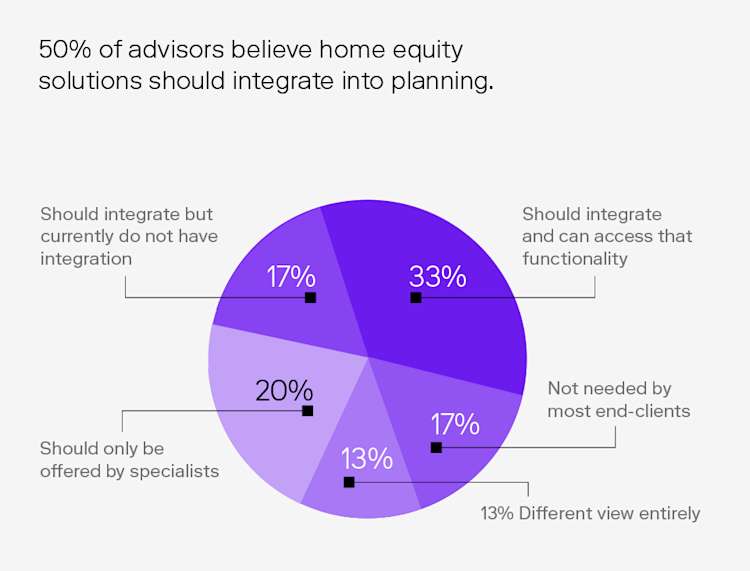

These data raise questions: If a trusted financial advisor is involved, should equity accumulated in a home be integrated into a holistic financial plan? Can financial advisors access tools to help them provide this service?

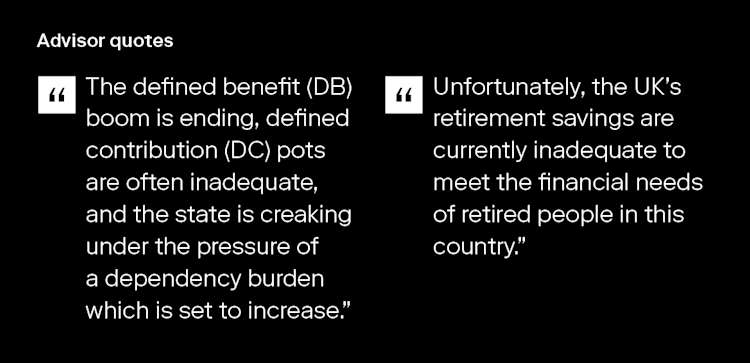

Against the backdrop of a looming retirement crisis in the United Kingdom, we asked UK advisors their thoughts. Here is what we discovered.

Please note that all adviser data are for the UK only. Research was conducted by the lang cat.

Most advisors believe that an end-client’s property wealth should be incorporated into several areas of financial planning…

And that home equity release should be used to address the pension gap.

How do financial advisors currently handle end-client needs for lending solutions?

Is lack of integration preventing advisors from offering equity release solutions?

This research revealed that almost every advisor interviewed gathers housing wealth information as part of the fact-find process of advice. But while housing wealth information is seen as essential to building a holistic wealth picture, it is used inconsistently (if at all) in holistic financial planning.

By integrating Nokkel’s property solution into FNZ’s global wealth management platform, financial institutions can offer customers a more holistic view of their entire asset portfolio, helping them making better financial decisions and connecting them to the right financial solutions.

Read the full research report here.

1. Anyone considering equity release should get advice from a qualified financial adviser. Financial plans that incorporate home equity release should include considerations of the risks involved with the product, including: financial risks such as interest rate risk, property value fluctuation, and debt accumulation; economic risks such as economic downturns and inflation; operational risks such as complexity of products and the potential for fraud; legal and regulatory risks such as shifting regulations or consumer protections; and personal investor risks such as longevity, impact on inheritance, and lifestyle.

Disclosures

The information contained within this publication is not intended as and shall not be understood or construed as financial advice. The information provided is intended for educational purposes only and you should not construe any such information or other material as legal, tax, investment, regulatory, financial or other advice. Nothing in this publication constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. FNZ Group and any of its affiliates are not financial advisors and strongly advise you to seek the services of qualified, competent professionals prior to engaging in any investment.

All opinions expressed by the authors of this publication are solely the authors’ opinions and do not reflect the opinions of FNZ Group, their parent company or its affiliates. You should not treat any opinion expressed by the author as specific inducement to make any specific investment or follow an investment strategy.