How the wealth industry’s supply chain is evolving to deliver personalized wealth management at massive scale.

Personalized investment solutions have always existed for the wealthy, but the rise of mass affluence, concerns over retirement provisions and increases in investor protection are driving a need to deliver custom wealth solutions on a mass scale. While some wealth managers and advisors are doubling down on the High-Net Wealth segments, many are fighting for a share of this growing mid-market client base, and coupled with regulatory legislation, this is leading to a dramatic shift in the industry structure. However, uncertainty around the right models for serving clients and technology challenges are making understanding the future global industry landscape far from easy.

Scaling personalization: a paradox?

Clearly there are limits to how much time expert investment advisors can spend customizing individual investor portfolios to every affluent individual. Indeed, growth in affluence has taken its toll as many advisor firms have built up large books of portfolios, often with a range of complex non-standard fee structures, which have become unwieldy to manage. On top of which are the expenses related to regulatory liabilities and required technology – and the general concern that many so-called custom portfolios have in fact a high degree of commonality. In view of which, the current shift to more standardized high-volume wealth platforms and quasi-custom investment solutions is hardly surprising. This half-way-house of personalization has led to the rapid rise in “managed” Model Portfolio Services and Direct Indexing solutions being used by advisors - frequently as outsourced services. But the growth in the use of solutions is also indicative of a major shift in the balance of the industry supply chain.

Where is the value in the supply chain?

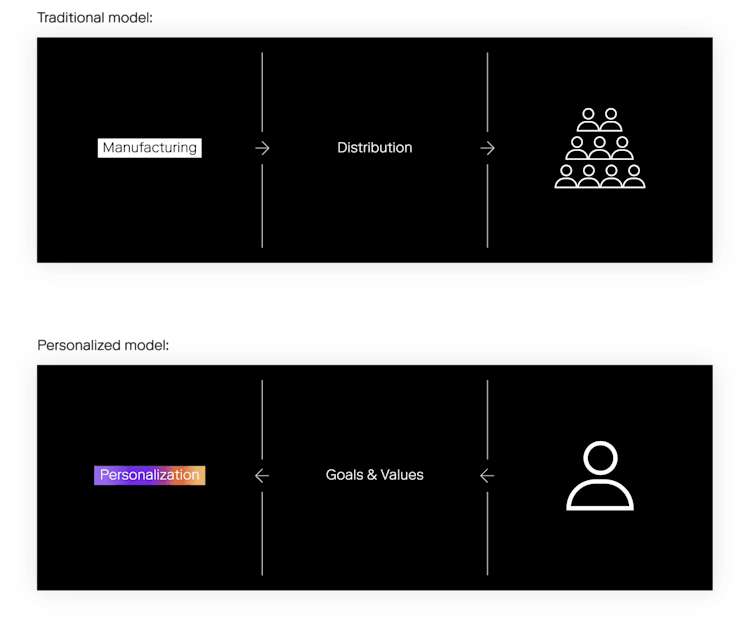

The industry supply chain for most of the retail and mass affluent wealth market worldwide has traditionally been aligned along a simple product manufacture and distribution model. The product manufacturer is the mutual ‘managed’ fund, and the distributors are a range of intermediaries such as banks, advisory firms or brokers. The fund managers receive the bulk of the fees, a portion of which, depending on the jurisdiction, may be passed-back to the intermediary for their distribution services. Most of the more advanced portfolio management technology and processes sit with and are undertaken by the manufacturer.

To achieve mass personalization the supply chain model has to be set-up differently. Intermediary wealth firms have a greater role in determining the personal portfolios of their client base as they are responsible for assessing their client’s goals, values and risk profiles. They determine the overall strategic asset allocations for their client, either from a wide range of micro-fund ‘modules’ (e.g. low-cost ETFs) or via direct indexing methods. Much more of the traditional portfolio management process and technology exists further down-stream – closer to the client. Fee models are frequently therefore different with intermediaries being able to charge directly for their more significant advisory and strategic allocation services; and in jurisdictions where commissions are banned, this has indeed become the norm.

Exhibit 1: Shifting from a traditional fund distribution model to personalized wealth management

Bringing asset managers and intermediaries together

Mass personalization is not however, as it may appear, a lose-lose game for asset managers. The move to mass personalization is spawning growth in an innovative range of solutions from asset managers and their suppliers to provide automated direct indexing and fund modularity technology and services to intermediaries to support them in growing their client business. Fundamentally it is a shift of the value chain that requires breaking down the traditional barriers between mutual fund managers and distributors, and brings part of the asset management expertise closer to the client.

Vertically integrated wealth platforms are at the center of this change, as technology and operational processes are needed to bring together a whole range of previously disconnected processes – end-to-end. For example, in the case of model portfolio services, the ability to create model portfolios for a firm’s clients requires a palate of asset manager provided ‘micro-fund’ modules to select from. These models need optimizing and regularly rebalancing, as do the underlying micro-funds managed by the asset manager, and this can be done more efficiently when all are working on one integrated capability. Moreover, the management and distribution of such products between parties, with their related reports and analytics – as well as fee redistribution – benefit from a single set of technology and operational capabilities.

Reconnecting the industry supply chain

Bringing state-of-the-art data analytics and technology to the whole supply-chain will provide some reassurance for regulators who are focusing on the need to protect investors from inappropriate investments. Increasingly they are asking for all participants in client investments, whether advisor, intermediate wealth management services or asset managers themselves, to take increased responsibility for investment suitability.

FNZ is reconnecting the wealth industry supply chain, from advisors and brokers through to dedicated wealth managers, asset managers and capital market firms. In doing so it aims to make personalization at scale a reality with cutting-edge technology and services, that ensures end investors have the transparency and control they need to make the right investments. To do this requires strong information flows, technology, processes and data analytics across the whole value chain for all the participants.

The information contained within this publication is not intended as and shall not be understood or construed as financial advice. The information provided is intended for educational purposes only and you should not construe any such information or other material as legal, tax, investment, regulatory, financial or other advice. Nothing in this publication constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. FNZ Group and any its affiliates are not financial advisors and strongly advise you to seek the services of qualified, competent professionals prior to engaging in any investment.

All opinions expressed by the author within this publication are solely the author’s opinion and do not reflect the opinions of FNZ Group, their parent company or its affiliates. You should not treat any opinion expressed by the author as specific inducement to make any specific investment or follow an investment strategy.