Advanced automation

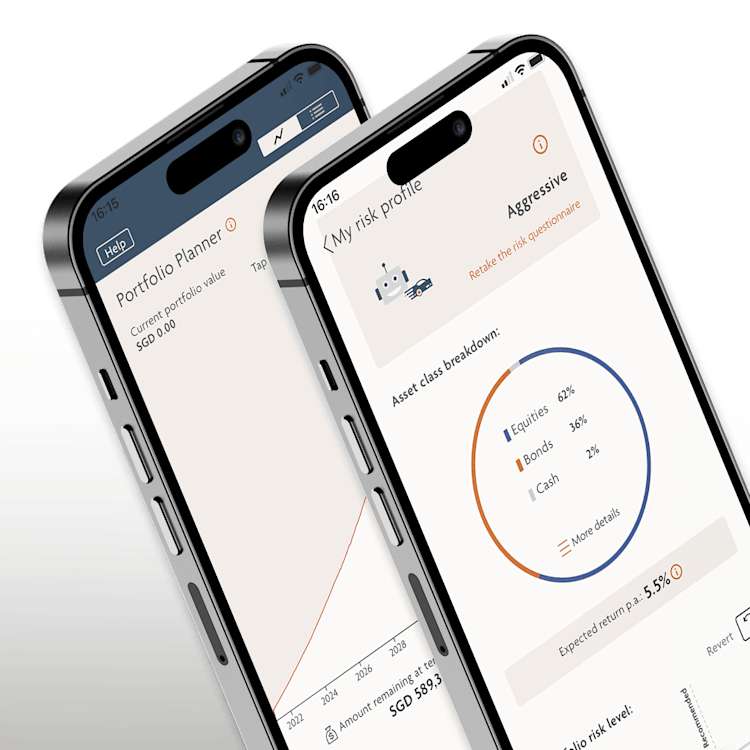

We have automated advanced quantitative capabilities to help asset managers construct, manage, and distribute scalable, personalized investment solutions.

Our advanced analytics unlock unique insights to help you deliver high-performing investment solutions.