FNZ’s recent acquisition of Swiss company New Access, aims to revitalise the private banking market and put the private banker back in the centre of the client relationship, says Mark Shields, Solutions Marketing Director, FNZ.

It is uncommon to attend an industry conference without a private banking executive promising to give the magical ingredients for an exceptional, holistic service for the ultra-wealthy. Only to be followed by concerns of being disintermediated to the role of mere financer to the wealthy. The potential loss of the ‘trusted investment adviser’ moniker is a legitimate concern in an industry continually buffeted by technology change and regulatory requirements.

The rise of family offices and private equity firms, independent financial advisers and asset managers is leaving some private bankers feeling the squeeze in their mission to deliver a comprehensive private wealth service.

The hyper-wealthy frequently tap into a range of private market investment opportunities by working directly with investment bankers and specialist investment firms. Meanwhile, the speed at which private banks and wealth managers can scale and adapt their offerings is often constrained by operational models and IT infrastructure built up and honed over many decades.

When priorities conflict, we fail to click

Delving into the typical private banking enterprise, one understands the many dilemmas and apparent conflicts that lead to such a moribund perspective. The executive teams have a broad and diverse set of responsibilities. Not least of these are the management of IT and operations.

The IT landscape is often littered with a wide range of specialist point solutions and expert systems, unconsolidated and often quite specific to the private banking niche. The reasons for their acquisitions are often lost in the passage of time or championed by colleagues long since moved on — a technical straight-jacket that galvanises the idea of business agility into submission.

Yet, sitting above this mish-mash of point solutions is an operation processing orders and servicing assets held under custody for fees charged to clients – which, while adding to profit, are fundamentally going down year after year. Asset serving and custody is a scale economics game, which few private banks have the size or strength to continue to master for the long term.

Nevertheless, using external service providers or low-cost outsourcers is often rebuffed by two fundamental realities of the private banking business model. One is that the service provided by private banks is, by definition, holistic, so there is an intrinsic belief that asset servicing is part of the proposition valued by wealthy clientele – and at its most basic sense of keeping client money secure, this is a relevant concern.

And secondly, because private banks do fundamentally strive to provide an exceptional, human-centric service: there is often a lack of trust in external back-office service providers as to whether they can provide an immediate and highly focused service response. They are sometimes compared to operations staff sitting in the same building or within reach of a quick phone call to a familiar person.

Despite these reservations, the economics of scale in asset servicing will play out. The struggle within private banks of managing a diverse set of conflicting objectives, and not spending 100% of management time focused on serving clients’ investment interests, means there needs to be a shift in how private banks are set up.

For many, the current market turmoil is tugging at the raw memories of the last financial crises, which exposed bank cost-income ratios to the ruthless forces of the market. This time will be no different. Banks that have not shifted their thinking in terms of back-office asset and custody services will hit rough seas.

FNZ’s recent acquisition of Swiss company New Access, aims to revitalise the private banking market and put the private banker back in the centre of the client relationship, says Mark Shields, Solutions Marketing Director, FNZ.

Getting private bankers back into business

Finding the right balance in asset servicing in wealth management is clearly tricky for the reasons outlined above. To rise to this challenge, FNZ teamed up with, and then acquired, the Swiss companies New Access and Appway in 2022.

FNZ serves over 650 wealth management firms across multiple industry sectors in more than 20 countries. New Access and Appway have brought an additional 300 people together as a private banking competence centre. They are focused on further developing the FNZ digital platform and ensuring that the complex specifics required to serve the private banking clientele are available as an end-to-end, full-service wealth platform.

Their experience in building private banking solutions and a comprehensive suite of technologies stems from serving a base of over 80 private banks and independent asset managers for over 30 years. Partnering with FNZ to tackle asset servicing economics is a sensible and realistic option for banks.

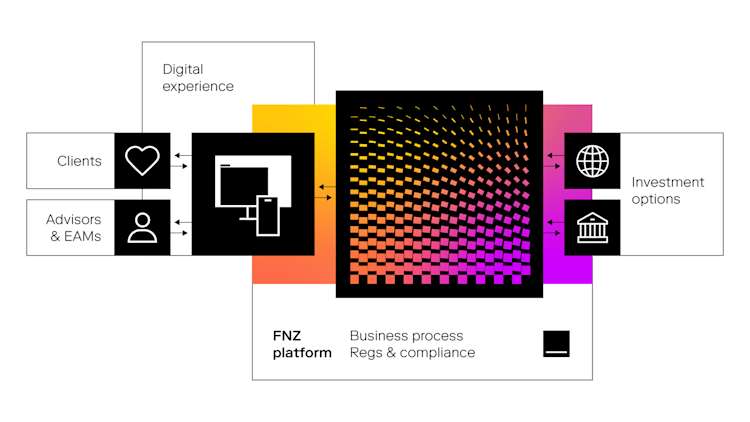

FNZ’s digital ‘platform’ model for private banks is tailored to the needs of serving the high-net-worth client base. It removes the need to manage the technical complexity and ever-present upgrade, test, and release cycle. It also delivers a state-of-the-art set of digital front-office, advisory and portfolio management experiences with full back-office transaction processing as a scalable and flexible service.

In combination with New Access and Appway technology, complex needs, for example, cross-border trust structures and the related compliance and onboarding workflows, are dealt with seamlessly. Ultimately, it ensures that the delicate balance between providing top-tier holistic private banking service at a reasonable cost of service can be maintained throughout the market turmoil and beyond.

Critically though, this model of operation puts the private banker back in control, with the management team wholly focused on servicing the client. The interplay between private banks, external asset managers, family offices and specific investment vehicles becomes central to the private banking business once again.

To read the full report by The Wealth Mosaic, please click here.