15 May 2024: A digital transformation is set to significantly change advisor roles and client experiences by 2028, as firms embrace innovation, AI, and automation. That’s the conclusion from FNZ’s major study into the future of the wealth management industry, which surveyed 250 firms and 2,000 investors globally.

But what does the future wealth advisor look like and how important will advice be for future investors?

The Rise of Bionic Advisors

Our global research demonstrates that advisors are going nowhere. But we are amidst an industry-wide shift as firms evolve to ensure they remain equipped to compete in a technology-first world. Those that don’t risk being left behind.

This calls for the rise of what we call - bionic advisors - those that are empowered by technology and are as digitally-savvy as their growing Gen Z customer base.

To succeed in the long-term, advisors will look to harness digital solutions to help them deliver what investors increasingly desire: greater value, personalization and specialized advice. Digital tools will free up time to allow advisors to focus on what they do best – delivering specialist, expert and trusted advice.

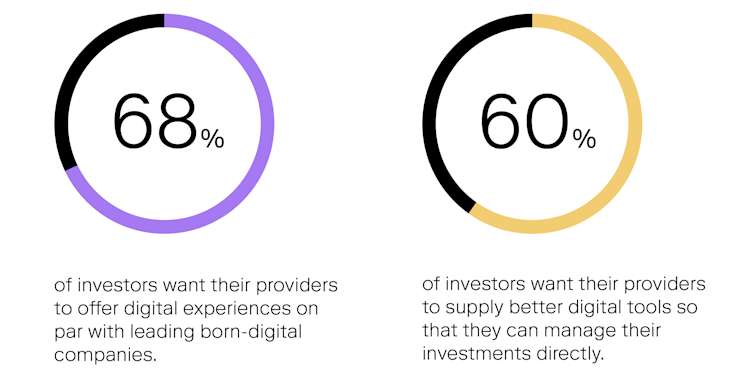

Take a look at a snapshot of some key data points from our study below:

68% of investors want their providers to offer digital experiences on par with leading born-digital companies.

60% of investors want their providers to supply better digital tools so that they can manage their investments directly.

Personalizing the investor experience

While firms have already made considerable progress in personalizing investor experiences, this trend is expected to continue to take hold. For example, currently half offer personalized any-device digital access, a figure expected to increase to 59% over the next three years. Similarly, 40% offer personalized financial planning tools for holistic analysis, a share that will grow to more than half.

In order to cater for these changes, the research shows how firms are anticipating an evolution in their ways of working and services offered to meet the evolving demands.

As Dean Butler, Managing Director at Standard Life UK predicts, a “new proposition is emerging: the bionic advisor”. This combines the digital-first, always-on approach with the support of a human, with the aim of “seamlessly integrating technology with financial advisors”.

A bionic model

This ‘bionic’ model is expected to become the prevailing approach firms adopt over the next three years, with 67% of firms surveyed expecting to move towards a hybrid, majority tech-enabled strategy.

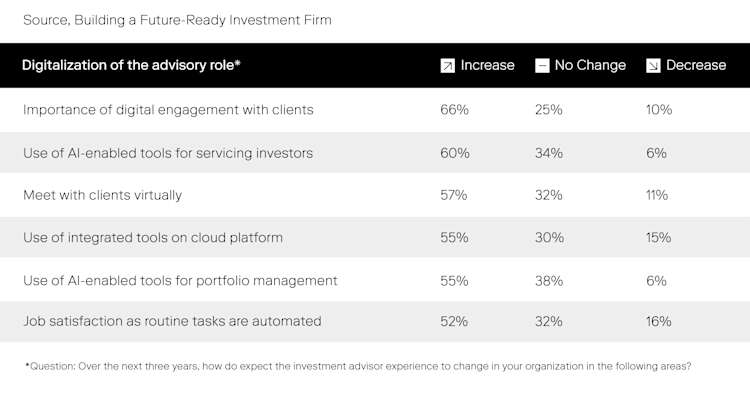

This shift towards higher productivity will be driven by a technological shift that adapts the role of the advisor to become more digital, automated, cloud-based and AI-enabled, allowing them to work more efficiently and improving their ability to work with more clients.

AI-enabled tools will support client relationship management, personalized financial planning, performance reporting, client onboarding, client communication, investment research, and data analysis, as well as with compliance tasks.

While technology will undoubtedly support evolving business approaches, there remains an incredibly important human role for the investment advisor. Over the next three years, nearly half of investors (46%) believe that the greatest value from advisors will derive from trusted investment advice, while 63% of wealth executives say the specialization of advisors will increase.

Brie Williams from State Street notes that technology will “enhance efficiencies and recalibrate strategies, [but] it falls short in providing emotional support and a holistic comprehension of clients’ unique life events”.

It is critical for investment providers to cultivate solid relationships with their customers. Commitment and retention can be strengthened by assigning specialized relationship managers as well as advisors to them while giving individualized support.

In the context of this technological sea change, FNZ is working alongside firms, many of which have been held back by pre-internet legacy infrastructure, to enable a digital transformation which opens up wealth for a wider group of investors. We support our customers with the automation of their back offices, which provides advisors with the freedom to personalize in the front office.

“We know from our research that the biggest issue advisors have with providers is existing service levels, and harnessing technology to improve this is absolutely essential. The use of digital solutions, be they hybrid or ‘bionic’ advice, and use of AI to automate many non-complex processes is steadily increasing, so increasing advisor satisfaction levels and ensuring good customer outcomes.”

Mark Polson, CEO and Founder, The Lang Cat.

The data used in the article above is taken from FNZ’s forward looking study: Building a Future-Ready Investment Firm. Download now to find out more about how investment providers are embracing new innovative technologies to thrive in the next era of investing as investor demographics and expectations shift worldwide.

If you're interested in learning more about how technology is transforming the role of advisors, then come along to The Lang Cat AdviceTech Catwalk event on the 20th of June and meet the FNZ team. Find out more and book your tickets here.